Are you a budding trader looking to break into the financial markets? Or perhaps an experienced strategist seeking to amplify your capital and refine your edge? The OANDA Prop Trader Challenge could be your gateway to a new level of trading success. This innovative program provides traders of all skill levels with the opportunity to manage substantial capital, hone their skills, and share in the profits. Let’s explore this exciting platform and discover how it can transform your trading journey.

Who is OANDA Prop Trader?

Who is OANDA Prop Trader? It is an extension of OANDA, a global leader in online trading services. OANDA has a long-standing history of innovation and customer focus, and the Prop Trader program reflects this commitment to empowering traders and fostering their success. OANDA provides opportunities for traders to access capital, enhance their skills, and share in the profits they generate.

What is the OANDA Prop Trader Challenge?

The OANDA Prop Trader Challenge is designed to identify and nurture talented traders. It provides a simulated trading environment where you can demonstrate your skills by meeting specific objectives. Think of it as an audition for a funded trading career. You can choose a challenge that aligns with your risk tolerance and experience level, ranging from $5,000 to $500,000 in virtual capital.

Passing the challenge unlocks the opportunity to become an OANDA Prop Trader, giving you access to real capital and a generous profit-sharing arrangement, up to 90% of the profits you generate. This is a fantastic way to scale your trading and potentially achieve significant financial gains without risking your own capital.

Decoding OANDA Account Types

The OANDA Prop Trading Platform offers two distinct challenge account types, each with its own set of rules and risk parameters: Trailing Drawdown (Classic Challenge) and Static Drawdown (Boost Challenge). Understanding the nuances of each account is crucial for selecting the one that best suits your trading style and risk appetite.

- Profit Target: 5% in Phase 1 and 5% in Phase 2.

- Daily Loss Limit: 5% from the previous End-of-Day (EoD) Equity. This limit protects your capital by preventing excessive losses in a single day.

- Maximum Drawdown: 10% trailing. The drawdown trails your highest equity, meaning it moves up as you make profits, providing a buffer against losses.

- Profit Share: 80%. You keep a substantial portion of the profits you generate.

- Maximum Daily Profit (Consistency Rule): Phase 1 is 5% | Phase 2 is 2%. This rule promotes consistency in trading performance.

- Maximum Leverage: Up to 1:100. Use leverage wisely to amplify potential gains, but remember that it also magnifies losses.

- News Trading: Allowed, with restrictions on opening or closing trades 2 minutes before and after major news releases.

- EA Allowed: You can use Expert Advisors (EAs) to automate your trading strategies.

- Inactivity Period: 30 days.

- No Time Limit: You can take as long as you need to complete the challenge.

- Profit Target: 10% in Phase 1 and 5% in Phase 2.

- Daily Loss Limit: 5% from the initial balance.

- Maximum Drawdown: 10% static. The drawdown remains fixed at 10% of your initial balance, regardless of your profits.

- Profit Share: Up to 90%.

- Maximum Daily Profit (Consistency Rule): Phase 1 is 5% | Phase 2 is 2%. This rule promotes consistency in trading performance.

- Maximum Leverage: Up to 1:100.

- News Trading: Allowed, with restrictions on opening or closing trades 2 minutes before and after major news releases.

- EA Allowed: You can use Expert Advisors (EAs) to automate your trading strategies.

- Inactivity Period: 30 days.

- No Time Limit: You can take as long as you need to complete the challenge.

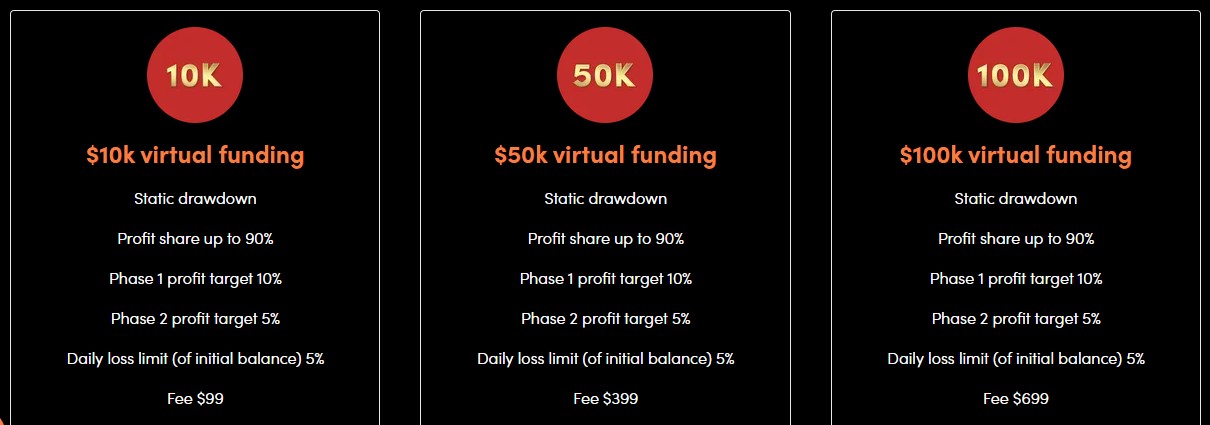

Choosing the Right OANDA Account Size

The OANDA Account Sizes available through the challenge cater to different risk appetites and trading styles. The Classic Challenge offers a wider range of account sizes, while the Boost Challenge focuses on a more streamlined selection. Select an account size that aligns with your trading experience and risk tolerance. Remember, the larger the account, the greater the potential profit, but also the greater the risk.

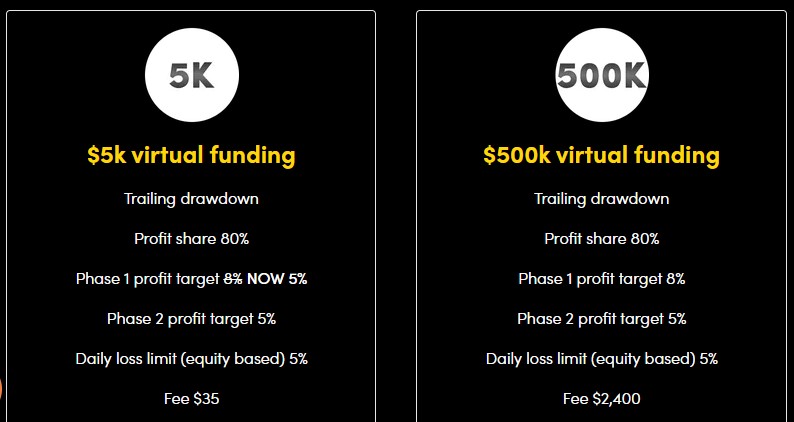

Trailing Drawdown (Classic Challenge):

* $5K for $35

* $10K for $60

* $25K for $199

* $50K for $299

* $100K for $599

* $188K for $888

* $250K for $1,200

* $500K for $2,400

Static Drawdown (Boost Challenge):

* $10k for $99

* $50K for $399

* $100K for $699

Funding Your OANDA Challenge: Payment Methods

OANDA provides a variety of convenient payment methods to fund your challenge:

- Credit/Debit Cards: A quick and easy way to get started. – Example: Visa, Mastercard

- Cryptocurrency: For those who prefer digital currencies. – Example: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC)

- e-Wallet: A secure and convenient online payment option. – Example: PayPal, Skrill, Neteller

- GPay: Seamlessly pay using your Google account.

- Apple Pay: A secure and private way to pay using your Apple devices.

- Wire Transfer: For larger transactions.

- Alipay: A popular option, especially for users in China.

Accessing Global Markets: OANDA Asset Classes

The OANDA Prop Trader Platform provides access to a wide range of asset classes, enabling you to diversify your trading strategies and capitalize on opportunities across various markets.

OANDA stands out for its competitive pricing, especially on popular instruments like currencies (FX) and gold. Spreads on major FX pairs can be as low as zero pips, and gold spreads start at just 0.1 pips. Additionally, OANDA charges a low commission of $7 per round lot traded. You can trade indices and commodities without incurring extra per-trade fees.

Unleash the Power of OANDA MetaTrader 5

The OANDA MetaTrader 5 (MT5) platform is a powerful and versatile trading platform that provides advanced charting tools, technical indicators, and automated trading capabilities. Here are some of the key features and benefits:

- Advanced Charting: MT5 offers a wide range of chart types, timeframes, and technical indicators to analyze price movements and identify trading opportunities.

- Automated Trading (EAs): You can use Expert Advisors (EAs) to automate your trading strategies, allowing you to trade around the clock without manual intervention.

- Multiple Order Types: MT5 supports a variety of order types, including market orders, limit orders, stop orders, and trailing stops, giving you greater control over your trades.

- Strategy Tester: Backtest your trading strategies using historical data to evaluate their performance and optimize your parameters.

- Customizable Interface: Personalize the platform to suit your preferences and trading style.

Supercharge Your Trading with OANDA Tools

OANDA provides a suite of proprietary tools designed to enhance your trading analysis and decision-making:

- Sentiment: Gauge the overall market sentiment to identify potential contrarian trading opportunities.

- Tropical Instruments: Access a range of exotic currency pairs and instruments.

- Currency Strength: Determine the relative strength of different currencies to identify potential trading opportunities.

- Currency Power Balance: Visualize the balance of power between different currencies.

- Volatility Chart: Analyze historical volatility patterns to assess risk and potential profit targets.

- Correlation Tool: Identify correlations between different assets to diversify your portfolio or hedge your positions.

- Value at Risk (VaR) Tool: Estimate the potential loss in your portfolio over a specific time horizon.

- Order Book and Position Book: Gain insights into market depth and order flow.

OANDA is Legal, Safe and Legit?

When considering any trading platform, security and legitimacy are paramount. OANDA is safe due to being a well-established and regulated broker with a strong reputation in the industry. For more than 25 years, OANDA has provided top notch brokerage services to clients around the globe. In addition to that, OANDA is legal since it adheres to the regulatory requirements in multiple jurisdictions. Finally, OANDA is legit because it has a proven track record of transparency and reliability.

The Is OANDA Prop Trader legal question is answered because the entity operates under the umbrella of a regulated financial institution, providing an additional layer of security and trust. Is OANDA Prop Trader legit due to its association with a reputable broker and its clear and transparent terms and conditions.

Navigating the OANDA Customer Support System

OANDA is committed to providing excellent customer support. They offer various channels to assist you with any questions or issues you may encounter:

- FAQ: A comprehensive knowledge base covering common questions and topics.

- Email: support-proptrader@oanda.com

- Address: OANDA Assessments Ltd, 171 Old Bakery Street, Valletta, VLT 1455 Malta, Company Registration Number: C 106331

- Live Chat: Available on the official website for instant assistance.

- Help Center: https://proptrader-help.oanda.com/

Whether you prefer self-service resources or direct interaction with support agents, OANDA has you covered.

Ready to Take the OANDA Prop Trader Challenge?

The OANDA Prop Trader Challenge offers a unique opportunity to elevate your trading career. With its flexible account types, diverse asset classes, powerful trading platform, and comprehensive support system, OANDA provides all the tools you need to succeed. Whether you’re a novice trader or an experienced professional, the OANDA Prop Trader Challenge could be the catalyst that unlocks your full trading potential.