Are you an aspiring or experienced trader seeking to elevate your career? Do you dream of managing significant capital and maximizing your profit potential? Look no further than QT Funded, a proprietary trading firm that’s rapidly gaining recognition in the financial world. Established in 2023, QT Funded provides traders with access to professional capital, cutting-edge technology, and competitive trading conditions. Let’s explore what makes QT Funded a compelling option for traders seeking to accelerate their growth through this QT Funded Review.

QT Funded Review: Who is QT Funded?

QT Funded is a proprietary trading firm that offers traders the opportunity to trade with the firm’s capital. Headquartered in London and with operations in South Africa, QT Funded has rapidly expanded its global presence, serving over 60,000 traders in more than 180 countries. This impressive growth speaks volumes about the firm’s appeal and the opportunities it provides to traders worldwide.

The firm operates under the regulation of the Financial Sector Conduct Authority (FSCA) with license number 53227. This regulatory oversight provides a level of security and stability, reassuring traders that they are operating within a legitimate and monitored environment. The FSCA regulation adds a layer of trust and transparency to QT Funded‘s operations, distinguishing it from unregulated entities.

QT Funded Account Types: QT Funded Challenges

QT Funded Account Types are structured to accommodate traders with varying levels of experience and risk tolerance. They offer three primary challenge types: QT Prime, QT Power, and QT Instant. Each QT Funded challenge presents unique evaluation criteria, profit targets, and risk management parameters. Let’s examine each of these account types in detail to help you determine which one aligns best with your trading style and objectives.

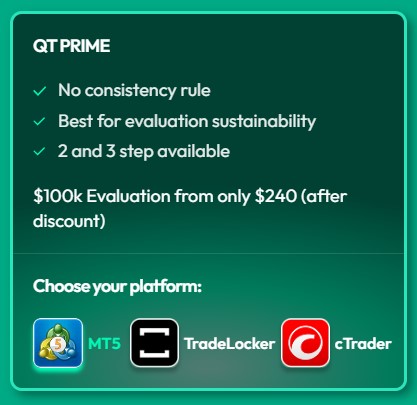

QT Prime Challenge

The QT Prime Challenge is a trading challenge that offers flexible evaluation options (2-Step or 3-Step) and structured risk management. Here are the key details:

- Evaluation Profit Targets:

2-Step: 8% (Step 1) | 5% (Step 2)

~ Account sizes and fees: $5K for $30 | $10K for $55 | $25K for $115 | $50K for $180 | $100K for $340 | $200K for $650

3-Step: 6% per Step

~ Account sizes and fees: $5K – $25 | $10K – $45.84 | $25K – $108.34 | $50K – $183.34 | $100K – $312.50 | $200K – $583.34

- Drawdown Limits:

~ Daily: 4% (fixed based on initial balance) – Resets at 1 am GMT+3 (DST) or Midnight GMT+2 (non-DST).

~ Maximum: 10% of initial balance

~ Equity Protector: Optional, auto-closes positions at 1.5% floating loss (delay possible, use Stop Losses). - Trading Day Requirements:

~ Minimum 4 trading days per phase (including funded accounts).

~ Funded traders need at least 2 profitable days with a minimum of 0.5% profit each - Funded Account Rules (Breaches Result in Account Termination):

~ Max Risk: No more than 2.5% of initial balance exposed at any time.

~ Gambling Policy: “All-or-nothing” strategies are prohibited.

~ News Trading: No opening/closing/adjusting trades 5 minutes before/after “Red Folder” news (SL/TP honored).

~ Layering: No more than three open positions on the same asset at the same time (NO LAYERING RULE – For Accounts purchased or issued after the 9th of April 2025).

~ Stop Loss: A Stop Loss must be placed within 60 seconds of opening a trade (NO STOP LOSS RULE – For Accounts purchased after the 13th of June 2025). - Account Conditions:

~ Raw Spreads + Commission ($4/lot round trip) or Variable Spreads (Commission-Free).

~ Swap-free accounts. - Leverage:

~ Forex: 1:50, Indices & Oil: 1:20, Metals: 1:15, Crypto: 1:1 - Payouts:

~ 80% profit split.

~ Bi-weekly payouts.

QT PRIME targets traders seeking optimal conditions and structured risk management.

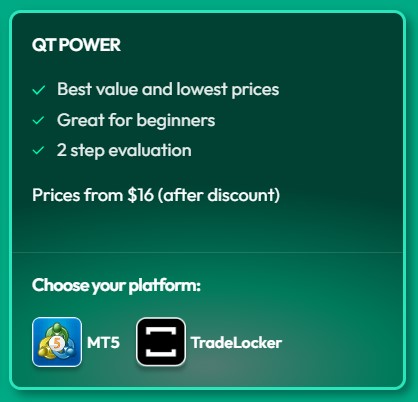

QT Power Challenge

QT Power Challenge is a trading account with a two-step evaluation process. Key details:

- Account sizes and fees: $5K – $13 | $10K – $26 | $25K – $52.50 | $50K – $105 | $100K – $200

- Profit Targets: 6% per phase.

- Drawdown Limits:

– Daily: 3% or 4% (EOD Equity, depending on purchase date).

– Max Loss: 8%. - Trading Days: Minimum of 4 trading days per phase.

- Leverage:

– Forex: 1:100

– Indices & Metals: 1:35

– Crypto: 1:2.5 - Key Rules:

– Consistency Rule: Maximum 35% consistency score (best trading day profit ÷ total profit x 100).

– Maximum risk per trade is 2% of the account balance.

– Gambling rule removed for newer accounts (after April 9, 2025).

– No “All or Nothing” trading strategies allowed. - Payouts: On demand, after meeting minimum days traded and consistency score.

- Profit Split: 80% for traders.

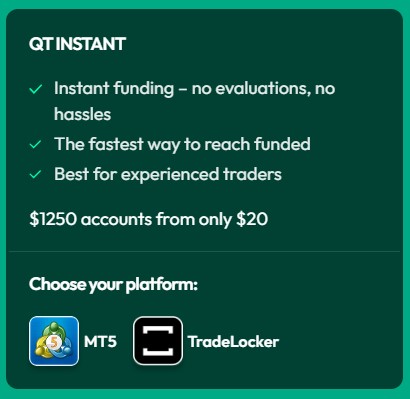

QT Instant

QT Instant offers immediate access to funded trading accounts without an evaluation phase, designed for experienced traders. It emphasizes strict risk management for sustainable trading.

Key Details:

- Account size and fees: $1.25K – $13 | $2.5K – $26 | $5K – $42 | $10K – $66 | $25K – $125 | $50K – $230

- Requirements Before Trading:

– KYC verification completed

– Contract signed

- Account Rules & Risk Management:

– Minimum Trading Days: 5

– Daily Drawdown: Fixed at 3% of initial balance, resets daily.

– Maximum Drawdown: Trailing 6% from the highest recorded balance or floating equity. Locked after withdrawals.

– Consistency Rule: No single day’s profit can exceed 25% of total profits at withdrawal.

– Layering Rule: No more than three open positions on the same asset.

– News Trading Rule: No trading around Red Folder news events.

– Max Risk Rule: 2% max risk allowed. - Withdrawal Conditions:

– Minimum Profit: 5% of the initial balance.

– Profit Split: 80% to the trader.

– Withdrawal Frequency: Biweekly. - Trading Costs & Leverage:

– Commission: $4 per round-trip lot on Raw Spread accounts.

– Leverage: Forex: 1:50 | Indices & Oil: 1:20 | Metals: 1:15 | Crypto: 1:1 - Consistency Score Reduction: Distribute profits evenly across multiple trading days.

Unlocking Your Potential: The QT Funded Scaling Plan

QT Funded goes beyond simply providing capital; it offers a structured scaling plan designed to reward consistent profitability and effective risk management. Traders can initially earn up to an 80% profit share, with the opportunity to increase this to 90% as they scale their accounts. The program allows trading on capital up to $2,000,000, providing significant leverage for skilled traders.

To scale your capital, you need to achieve a 10% net profit, receive a minimum of three payouts, and ensure the final trading cycle ends with a positive account balance. Successful completion of these conditions can lead to an increase in account size by $20,000 at each scaling cycle. This structured approach to scaling incentivizes traders to maintain consistent performance and manage risk effectively, fostering long-term success. Consistent performance over an uninterrupted 8-week period can also result in a profit share boost, further rewarding skilled and disciplined traders.

Exploring the QT Funded Prop Trading Platform

QT Funded Prop Trading Platform is designed to cater to diverse trading styles and preferences. As part of this QT Funded Prop Platform, the company provides access to several platforms, including the industry-standard MetaTrader 5, cTrader, and their proprietary Tradelocker platform. Traders can choose the platform that best suits their trading strategies and technical analysis requirements. Whether you prefer the advanced charting capabilities of MetaTrader 5 or the intuitive interface of Tradelocker, QT Funded offers a platform to match your needs.

QT Funded MetaTrader 5 (QT Funded MT5)

QT Funded MetaTrader 5 is a powerful and widely used platform known for its advanced charting capabilities, multi-timeframe analysis, and precision execution tools. QT Funded MT5 is optimized to provide traders with a competitive edge. It is available for Web browsers, Android, iOS, and Desktop, offering flexibility and accessibility. The platform supports a wide range of order types, technical indicators, and automated trading strategies, making it a favorite among both novice and experienced traders.

Tradelocker Platform

The Tradelocker platform is designed with an intuitive interface and comprehensive risk management tools. It offers seamless trade execution and is optimized for traders seeking a user-friendly experience. Tradelocker is available on Web, Android, iOS, and Desktop, providing traders with the flexibility to trade from anywhere.

cTrader Platform

cTrader is known for its modern interface, advanced order management, and institutional-grade execution. It provides lightning-fast trades with minimal slippage, making it a preferred choice for traders who prioritize speed and precision. cTrader is available on Android, Web, iOS, and Desktop, ensuring traders can access the platform from their preferred device.

The availability of multiple platforms underscores QT Funded’s commitment to providing a tailored trading experience. Each platform offers unique tools and features, allowing traders to execute trades efficiently and effectively. By offering this choice, QT Funded empowers traders to leverage the technology that best supports their individual trading goals.

Sharpening Your Edge: QT Funded Education Resources

QT Funded recognizes the importance of continuous learning and provides a range of educational resources to help traders enhance their skills and knowledge. These resources include blogs, market analysis, news, webinars, events, and workshops.

The blog provides valuable insights into trading strategies, risk management techniques, and market analysis. It is a great resource for traders looking to stay up-to-date on the latest market trends and developments. Market analysis and news provide traders with real-time information and expert commentary on market movements. This information can help traders make informed decisions and identify potential trading opportunities. Webinars, events, and workshops offer traders the opportunity to learn from experienced professionals and interact with fellow traders. These events provide valuable insights into advanced trading techniques, risk management strategies, and market analysis.

QT Funded Review: Is QT Funded Legal?

One of the first questions any trader should ask before joining a prop firm is: “Is QT Funded legit?” and “Is QT Funded safe?”. With its FSCA regulation, the answer is a resounding yes. QT Funded is legal and operates within a defined regulatory framework. This is a significant advantage, providing traders with confidence in the firm’s legitimacy and commitment to ethical practices. Furthermore, the fact that QT Funded is safe is backed by its commitment to innovation and maintaining a secure trading environment. This regulation ensures that QT Funded adheres to specific standards of operation, offering traders a protected and reliable platform.

Conclusion: Is QT Funded a Good Choice For You?

In conclusion, QT Funded stands out as a reputable and regulated proprietary trading firm that offers traders access to capital, technology, and education. With its diverse range of account types, structured scaling plan, and commitment to trader development, QT Funded provides a compelling platform for traders seeking to elevate their careers. Whether you are an experienced trader or just starting out, QT Funded offers the resources and support you need to succeed in the competitive world of proprietary trading. – QT Funded Review