Dreaming of trading Forex with serious capital but tired of risking your own savings? FundingPips promises to be the answer, offering a clear path to funded trading for talented individuals. But is it the real deal? In this FundingPips review, we dive deep into their evaluation process, platform options, and trader benefits to help you decide if it’s the right launchpad for your Forex ambitions. – FundingPips Review 2025

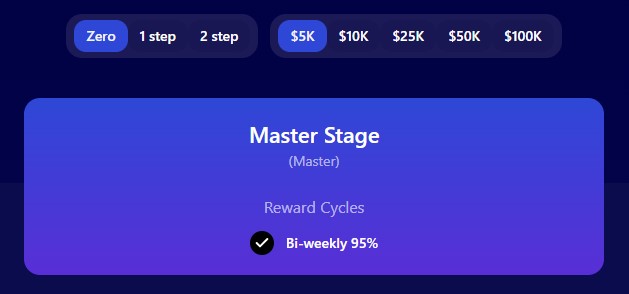

FundingPips has a special “Zero Evaluation” course that lets you get a “Master” account right away. But you need to be good at trading and managing risk. If you break any of the rules, FundingPips will close all your trades, shut down your account, and you won’t get any money.

Here’s a breakdown of some key rules:

- 3% Daily Loss Limit: You can’t lose more than 3% of your account’s starting balance in one day.

- 5% Total Loss Limit: Your account balance can’t drop more than 5% below its highest point. This limit moves up as your account grows.

- No News or Weekend Trading: You can’t hold trades over the weekend or 10 minutes before/after big news events.

- Trading Strategy: Trade how you like, but no cheating! Things like fast trading, exploiting server issues, copying others, or using certain automated programs are not allowed. You can use an automated program just to manage your trades not automate the trade.

- 15% Consistency Score: Your best day of profit can’t be more than 15% of your total profits.

- 1% Risk Limit: Your open trades can’t be losing more than 1% of your account at any time.

- 7 Profitable Days: You need at least 7 days with profits of 0.25% or more within each 30-day period.

FundingPips challenge types for zero evaluation provide tiered account sizes from $5K to $100K, priced between $69 and $499. Traders can choose an account size matching their risk profile and trading strategy, gaining immediate access to live trading without initial evaluation.

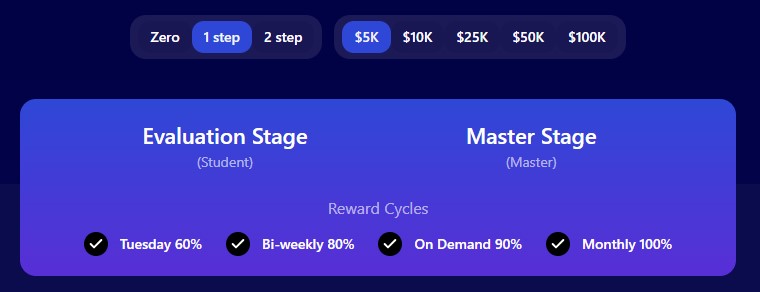

FundingPips has a 1-Step Evaluation to find master (funded) traders. You need a good trading system and risk plan to pass. First, you complete the Student Phase by reaching a 10% profit target, trading for at least 3 days, and following all the rules. Then, the FundingPips Risk Team will review your trading in two business days.

During the Student Phase, you can’t lose more than 3% of your account in one day, or more than 6% overall. You can trade news events and hold trades over the weekend during the Student Phase. Once you become a Master trader, news trading rules depend on the reward cycle you choose. Some strategies are not allowed, like gap trading, high frequency trading, toxic trading, hedging, or using a third-party to copy trades. If you break any rules, your account will be closed, and you won’t get any rewards.

FundingPips challenge types for 1-step evaluation account sizes ranging from $5K for $59 to $100K for $555.

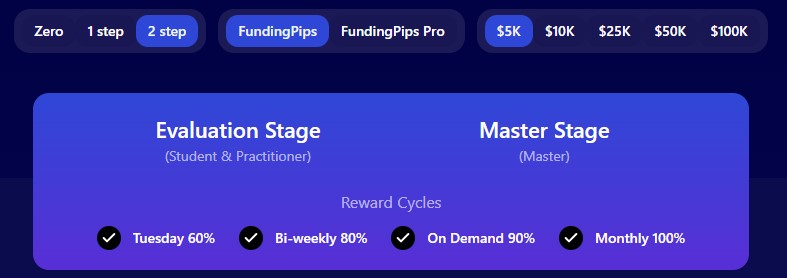

To become a funded trader with FundingPips, you need to pass their Evaluation course. This course has two parts: Student and Practitioner. It’s important to have a good trading system and know how to manage risk to pass.

After you reach your profit goal in the second part (Practitioner), FundingPips’ team will check your trading to make sure you followed the rules. This takes about two business days. If you break any rules, they will close your trades, close your account, and you won’t get any rewards.

Here’s what you need to do in each phase:

* Student Phase: Make 8% or 10% profit (depending on the account) and trade for at least 3 days.

* Practitioner Phase: Make 5% profit and trade for at least 3 days.

Important Rules to Follow:

* Daily Loss Limit: You can’t lose more than 5% of your account’s starting balance each day.

* Overall Loss Limit: You can’t lose more than 10% of your account’s starting balance overall.

During the Evaluation course, you can trade news and hold trades over the weekend.

In the Master stage, it depends on the reward cycle you choose. With the On-Demand cycle, you can trade news. With other cycles, there are restrictions. FundingPips challenge types for 2-step evaluation account sizes ranging from $5K for $36 to $100K for $529.

You can trade how you like, but certain strategies are not allowed. These include things like gap trading, arbitrage, and using certain types of Expert Advisors. Also, you cannot copy trade or have someone else manage your account.

MetaTrader 5 (MT5) is a sophisticated trading platform offered by FundingPips, designed to provide traders with advanced tools and functionalities for trading various financial instruments. MT5 supports trading in Forex, commodities, indices, and cryptocurrencies, making it a versatile choice for diverse trading strategies. Key features include advanced charting tools with multiple timeframes and technical indicators, depth of market (DOM) for real-time liquidity data, and an economic calendar for tracking important economic events. The platform also supports automated trading through Expert Advisors (EAs), enabling traders to implement and backtest algorithmic trading strategies.

Match-Trader is one of the trading platforms offered by FundingPips, providing traders with a unique and versatile environment for accessing financial markets. Match-Trader’s features and benefits within FundingPips generally includes tools for trading various instruments such as Forex, commodities, and indices. Traders can typically expect features like real-time market data, charting tools, and order management capabilities. The platform is designed to cater to both beginner and experienced traders, offering a user-friendly interface and customization options to suit individual trading styles. – FundingPips Match-Trader

FundingPips offers the cTrader platform, known for providing a premium mobile trading experience that allows users to trade global assets such as Forex, metals, oil, indices, stocks, and ETFs. FundingPips cTrader is a direct processing (STP) and no dealing desk (NDD) trading platform that provides detailed symbol information, helping traders understand the assets they are trading. It features symbol trading schedules to show when the market is open or closed, links to news sources that may affect trading, fluid and responsive charts, and a quick trade mode for one-click trading. The platform also offers a market sentiment indicator to show how other people are trading, along with sophisticated technical analysis tools, including various chart types, view options, drawing tools, and popular technical indicators. Additional features include push and email alert configurations, the ability to manage all accounts in one app, trade statistics, price alerts, symbol watchlists, session management, a dark theme, and availability in multiple languages.

FundingPips offers a variety of payment options to accommodate traders worldwide, ensuring convenient and secure transactions. These options range from traditional methods to modern e-wallets, providing flexibility for funding accounts.

- Credit/Debit Cards: FundingPips accepts Visa and Mastercard, offering a familiar and widely used method for instant transactions.

- AstroPay: This is a popular payment solution in Latin America and other regions, providing a secure way to make online payments without needing a credit card.

- Apple Pay: Designed for users within the Apple ecosystem, Apple Pay allows for secure and instant transactions directly from Apple devices.

- Paysafe Card: This prepaid card option offers a secure and instant payment method, ideal for users who prefer not to use credit or debit cards online.

- E-wallets: FundingPips supports Neteller and Skrill, which are digital wallets that provide instant transactions and are widely used among international traders.

- Gpay: Also known as Google Pay, this option allows users to pay directly from their Google accounts, offering a quick and seamless transaction process for Android users.

Determining the legitimacy and safety of a proprietary trading firm like FundingPips requires careful consideration. When evaluating whether FundingPips is legit and FundingPips is safe, it’s essential to look at several factors, including their regulatory status, operational transparency, and user reviews.

While FundingPips may not be regulated by a traditional financial authority, it’s important to note that many prop firms operate without direct regulatory oversight. Instead, they focus on maintaining internal controls and risk management protocols to ensure a secure trading environment. FundingPips employs stringent fraud prevention measures, including KYC (Know Your Customer) verification processes, to ensure the legitimacy of its clients and protect user data and payments.

Ultimately, determining whether FundingPips is legal involves assessing these measures and considering the experiences of other traders. While some reviews may express concerns, many users report positive experiences with the platform’s funding opportunities and profit-sharing arrangements.

When choosing a proprietary trading firm, FundingPips stands out for several compelling reasons. Here’s why traders are increasingly turning to FundingPips to elevate their Forex careers:

- Zero Reward Denials: FundingPips prides itself on its commitment to transparency and fairness, ensuring that traders who meet the criteria receive their rewards without unwarranted denials.

- Renowned Platforms: Access a range of industry-leading platforms, including MetaTrader 5, Match-Trader, and cTrader, each offering advanced tools and features to suit various trading styles and preferences.

- Flexible Reward Cycles: FundingPips provides flexible reward cycles, allowing traders to choose the frequency of their payouts, whether it’s on-demand, bi-weekly, or monthly, aligning with their financial goals and strategies.

- Trade with Substantial Capital: Traders have the opportunity to manage up to $300,000 in simulated capital, providing a significant advantage in the Forex market and the potential for substantial profits.

These factors combine to make FundingPips a compelling choice for traders seeking a supportive and rewarding environment to hone their skills and achieve their financial aspirations.

So, what’s the final verdict on FundingPips? Is it the golden ticket to Forex success, or just another prop firm promising the moon? The truth, as always, lies somewhere in between. FundingPips offers a compelling opportunity for skilled traders to access capital and prove their mettle, with a clear path through their evaluation stages and a generous profit-sharing model.

However, like any trading platform, it’s not without its risks. Success requires discipline, skill, and a solid understanding of risk management. FundingPips isn’t a magic money tree – you’ll need to put in the work to reap the rewards.

Ultimately, whether FundingPips is right for you depends on your individual trading style, risk tolerance, and goals. If you’re a serious trader with a proven track record and a hunger for success, FundingPips could be the launchpad you need to take your Forex career to the next level. Just be sure to do your homework, understand the rules, and trade responsibly.