Are you searching for a FundedNext prop firm review to determine if it’s the right prop trading platform for you? Look no further! In this FundedNext Prop Trading Platform review, we’ll dive deep into what FundedNext offers, exploring everything from its funding models and trading conditions to its educational resources and community support. We’ll give you an unbiased look at the pros and cons, helping you make an informed decision about whether FundedNext is the prop trading partner you’ve been looking for. Let’s get started with this FundedNext Prop firm Review!

Who is FundedNext?

FundedNext is a proprietary trading firm that provides traders with the opportunity to manage substantial capital and earn significant profit splits. Unlike traditional trading where traders risk their own funds, FundedNext offers a platform where traders can demonstrate their skills through evaluation challenges. Upon successful completion, traders are allocated a funded account, allowing them to trade with the firm’s capital. FundedNext distinguishes itself through its diverse funding models, comprehensive educational resources, and a supportive community, aiming to empower traders globally and provide them with the tools and resources necessary to succeed in the financial markets.

Navigating the FundedNext Account Types

FUNDEDNEXT CFDs

FundedNext offers Contracts for Difference (CFDs) across various account types, providing traders access to a wide range of markets. CFDs are available on Stellar 2-Step, Stellar 1-Step, Stellar Lite, and Stellar Instant accounts, allowing traders to speculate on the price movements of assets such as indices, commodities, and cryptocurrencies without owning the underlying asset. FundedNext encourages traders to use lower leverage on CFDs to manage risk effectively, particularly in volatile markets, which can help in limiting potential losses and reducing transaction costs

Stellar 2 – Step

The FundedNext Stellar 2-Step Account offers a pathway to accessing substantial trading capital through a two-phase evaluation process. This account type is designed for traders who prefer a more streamlined evaluation before managing a fully funded account.

Key features of the FundedNext challenge type Stellar 2-Step Account include:

- Account Sizes: Available from $6K to $200K.

- Challenge Fee: Ranges from $59 to $1,099, depending on the account size.

- Performance Reward (Challenge Phase): 15% of profits earned during the evaluation phases.

- Profit Targets: 8% profit target for Phase 1, and 5% profit target for Phase 2.

- Maximum Loss: 10% maximum overall loss allowed.

- Daily Loss Limit: 5% maximum daily loss permitted.

- Trading Style: News trading is allowed.

- Profit Split: Up to 95% performance reward on the funded account.

- Minimum Trading Days: Requires a minimum of 5 trading days to complete the challenge.

- Withdrawal: The first withdrawal is available after 21 days.

- Refundable Fee: The initial challenge fee is refundable upon successful completion and meeting certain criteria.

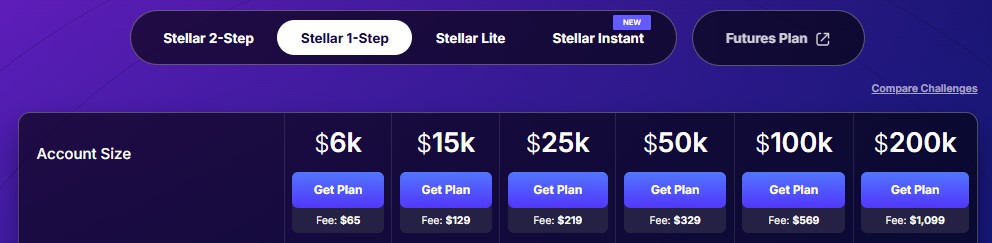

Stellar 1 – Step

FundedNext Stellar 1-Step Account offers a streamlined path to funded trading, designed for experienced traders who are confident in their abilities. This account type allows traders to bypass lengthy evaluation processes and gain access to significant capital relatively quickly. Account sizes range from $6,000 (for a fee of $65) up to $200,000 (for a fee of $1,099), offering flexibility based on individual trading strategies and risk tolerance. This FundedNext challenge type is straightforward, requiring traders to meet a 10% profit target while adhering to a 6% maximum overall loss and a 3% maximum daily loss. Notably, news trading is permitted, providing traders with more opportunities to capitalize on market movements. Upon successful completion and allocation of a live account, traders can earn up to 95% of the profits generated. Furthermore, the fee is refundable upon the first withdrawal.

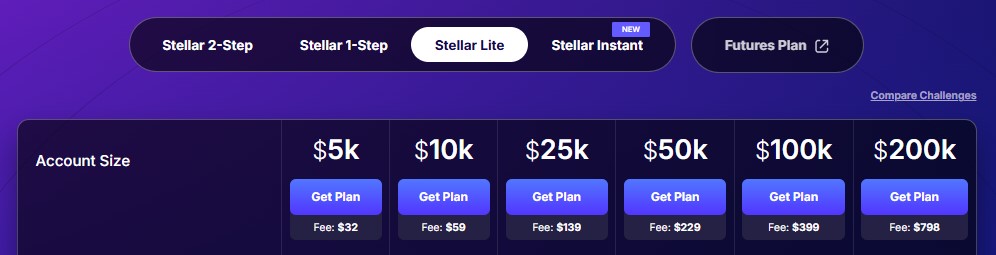

Stellar Lite

FundedNext offers the Stellar Lite account type, designed to provide traders with a streamlined path to accessing funded capital. This account option features a range of sizes, from $5,000 for a fee of $32 up to $200,000 for $798, catering to various experience levels and risk appetites. The Stellar Lite challenge requires traders to meet a profit target of 8% in Phase 1 and 4% in Phase 2, while adhering to risk management rules including an 8% maximum overall loss and a 4% maximum daily loss. Notably, the Stellar Lite account allows for news trading strategies. Successful traders can earn up to a 95% performance reward. The account also requires a minimum of 5 trading days and allows for the first withdrawal after 21 days. Furthermore, the fee paid for the Stellar Lite challenge is refundable upon successful completion.

FundedNext challenge type Stellar Lite key features:

- Account Sizes: Ranges from $5K (for $32 fee) to $200K (for $798 fee)

- Profit Target: 8% in Phase 1, 4% in Phase 2

- Maximum Overall Loss: 8%

- Maximum Daily Loss: 4%

- News Trading: Allowed

- Performance Reward: Up to 95%

- Minimum Trading Days: 5 days

- First Withdrawal: After 21 days

- Refundable Fee: Yes, upon successful completion

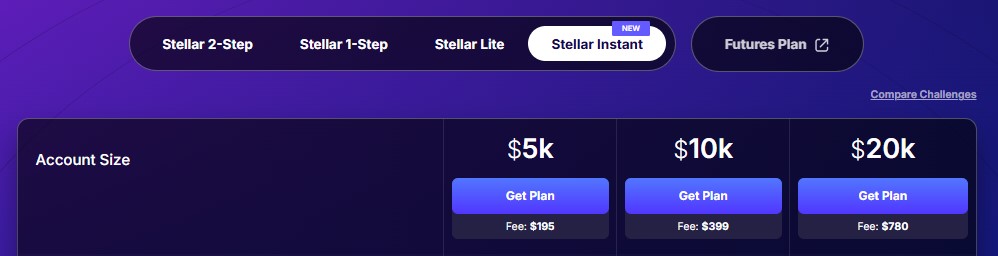

Stellar Instant

FundedNext offers the Stellar Instant Account, designed for traders seeking immediate access to funded capital with fewer restrictions. This account type provides traders with a streamlined path to managing a funded account, emphasizing flexibility and on-demand rewards. Traders can choose from account sizes ranging from $5,000 (for a fee of $195) up to $20,000 (for a fee of $780). The Stellar Instant Account features a 6% maximum overall loss limit, allowing for a more aggressive trading style as there is no maximum daily loss constraint. This account uses a trailing maximum loss limit, providing traders with some flexibility as their account grows. Traders can also trade during news events and hold positions over the weekend, offering increased trading opportunities. Successful traders can earn up to 80% of the profits generated, with the added benefit of on-demand reward payouts. Notably, the Stellar Instant Account has no consistency rule, providing traders with the freedom to implement various trading strategies. It’s important to note that the fee for this account is non-refundable.

FundedNext Stellar Instant key features:

- Account Sizes: $5K (for $195), $10K, $15K, and $20K (for $780).

- Max Overall Loss: 6%.

- Max Daily Loss: None.

- Loss Limit Type: Trailing max loss.

- News Trading: Allowed.

- Weekend Holding: Allowed.

- Performance Reward: Up to 80%.

- Reward Payout: On demand.

- Consistency Rule: None.

- Fee: Non-refundable.

FUNDEDNEXT FUTURES: Rapid and Legacy Challenge

FundedNext’s Rapid Challenge offers traders a fast-track evaluation process with varying account sizes to suit different risk appetites and trading goals. Traders can choose from account sizes of $25,000 for a fee of $79, $50,000 for $129, or $100,000 for $279. The corresponding profit targets for these accounts are $1,500, $3,000, and $5,000, respectively. A key feature of the Rapid Challenge is the absence of a daily loss limit, providing traders with more flexibility in their trading strategy. However, there are maximum loss limits of $1,250, $2,000, and $2,500 for the respective account sizes. There is no activation fee for any challenge size, and the fee is a one-time payment. In the event of a challenge reset, traders benefit from a 10% discount on the reset fee.

FundedNext’s Legacy Challenge offers a futures trading evaluation with rules similar to the Rapid Challenge but features tighter loss limits. Account options include $25,000 for $129, $50,000 for $249, and $100,000 for $449, with respective profit targets of $1,250, $2,500, and $6,000. Traders receive a 15% performance reward from the challenge phase, amounting to $187, $375, and $900, respectively, based on the account size. A daily loss limit (soft breach) is in place at $600, $1,200, and $2,400, while the maximum loss limit is $1,250, $2,500, and $3,000, respectively. All Legacy Challenges have no activation fee, require a one-time payment, and offer a 10% discount on the reset fee. Position limits vary by account size, with restrictions on both the challenge and FundedNext account phases for mini and micro contracts. A 40% consistency rule is also in effect.