Are you looking to amplify your trading potential with a proprietary trading firm? Then you’ve likely come across FTUK. In this comprehensive FTUK review, we will dive deep into the FTUK prop trading platform, dissecting the various FTUK challenge types, account features, and trading instruments available. Whether you’re a seasoned trader or just starting, this guide will help you understand what FTUK offers and whether it aligns with your trading goals.

Who is FTUK? Unveiling the Prop Trading Firm

Who is FTUK? FTUK, or Funding Traders UK, is a proprietary trading firm that provides traders with capital to trade the financial markets. Instead of risking your own capital, you can trade with FTUK’s funds and share the profits. This model allows traders to access larger capital pools, potentially increasing their earnings.

Furthermore, FTUK provides a structured environment where traders can prove their skills through evaluation challenges. Successful completion of these FTUK challenges leads to funded accounts where traders can execute their strategies and earn a profit split. FTUK equips traders with the tools and resources necessary to succeed, including a range of trading platforms, educational materials, and community support. – FTUK Review

FTUK Account Types: Navigating the Challenge Landscape

FTUK offers a variety of account types tailored to different trading styles and risk tolerances. Each account type comes with its own set of rules, profit targets, and scaling plans. Understanding the nuances of each option is crucial for choosing the one that best suits your needs. Let’s explore the primary account types in detail:

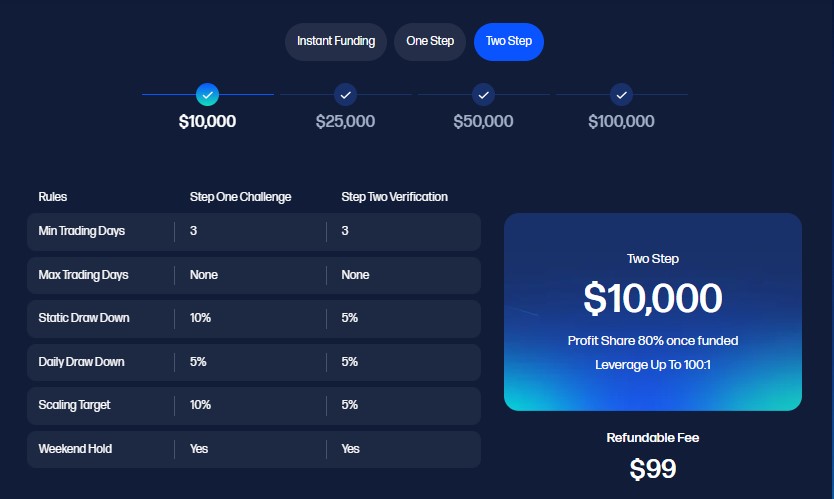

Step 1 – Challenge

– Min Trading Day: 3 days

– No time limit

– Max drawdown: 10% (static)

– Daily drawdown: 5% (balance based)

– Profit target: 10%

– Leverage: 1:30

– News trading NOT allowed.

Step 2 – Verification

– Min trading day: 3 days

– No time limit

– Max drawdown: 5% (static)

– Daily drawdown: 5% (balance based)

– Profit target: 5%

– Leverage: 1:30

– News trading NOT allowed.

Funded

– NO min trading day

– NO Time Limit

– Max drawdown: 10% (static)

– Daily drawdown: 5% (balance based)

– Profit target: 10%

– Profit split: 80%

– Leverage: 1:30 to 1:100

– News trading NOT allowed.

– Refundable fee

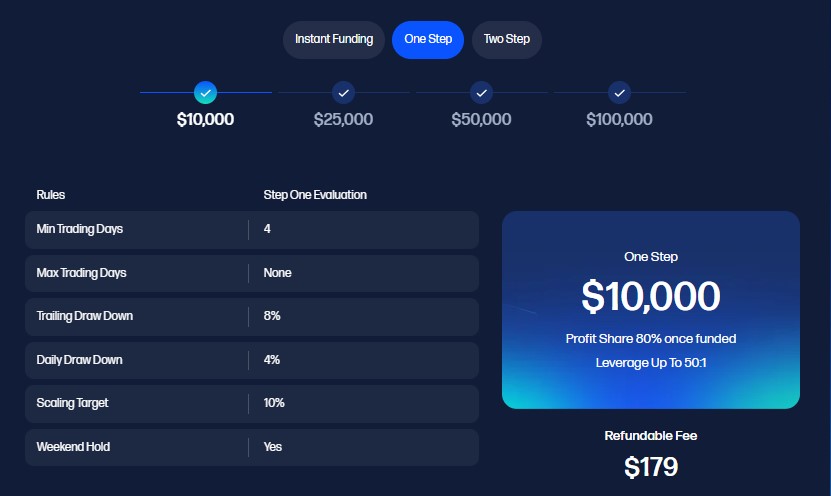

Step 1 – Challenge

– Min trading day: 4 days

– NO time limit

– Max drawdown: 8%

– Daily drawdown: 4% (balance-based)

– Scaling target: 10%

– Profit split: NONE

– Leverage: 1:10

– News trading NOT allowed

– Weekend holding ALLOWED.

Funded

– Min trading day: 4 days

– NO time limit

– Max drawdown: 8%

– Daily drawdown: 4% (balance-based)

– Scaling target: 10%

– Profit split: Up to 80%

– Leverage: 1:10 to 1:50

– News trading NOT allowed

– Weekend holding ALLOWED.

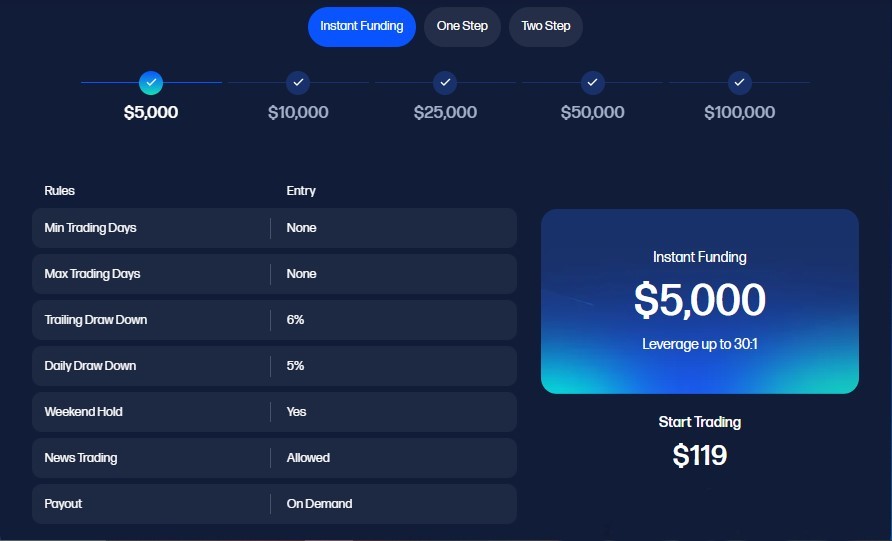

INSTANT FUNDING PROGRAM

- Account Sizes and Fees: $5,000 for $119 | $10,000 for $199 | $25,000 for $374 | $50,000 for $749 | $100,000 for $1,499

This program provides immediate access to a funded account without any evaluation phases.

Traders receive a funded account right away but must still adhere to specific rules. The maximum drawdown is 6%, and there is no daily drawdown limit. To scale, traders must meet a 10% scaling target. The profit split can reach up to 80%, and leverage ranges from 1:10 to 1:50. Weekend holding is allowed, and payouts are available on demand.

FTUK Free Trial Account: Practice Makes Perfect

FTUK provides a FTUK free trial account, giving traders the chance to experience live forex market trading without any financial risk. This is an excellent opportunity to familiarize yourself with the FTUK prop platform, test your strategies, and refine your skills before committing to a paid FTUK challenge. Take advantage of this risk-free environment to hone your trading abilities and gain confidence.

FTUK Instruments: Diversifying Your Trading Portfolio

FTUK prop trading platform offers a variety of trading instruments, enabling traders to diversify their portfolios and capitalize on different market opportunities. These instruments include:

- Forex: Trade major, minor, and exotic currency pairs. Leverage increases with account balance within the scaling plan.

- Commodities: Trade precious metals and other commodities. Non-metal commodities leverage is fixed at 5:1, while metals leverage is fixed at 10:1.

- Indices: Trade major stock indices. Indices’ leverage is fixed at 5:1.

- Cryptocurrencies: Trade popular cryptocurrencies with fixed leverage of 2:1.

FTUK Trading Platforms: Your Gateway to the Markets

FTUK offers a selection of trading platforms, each with its own features and benefits:

- TradeLocker: A user-friendly platform available on Web, Windows, MacOS, iOS, and Android. It offers advanced charting tools, order management features, and a customizable interface.

- DX Trade: A streamlined platform available on Web and Android, designed for ease of use and accessibility.

- Match-Trader: A web-based platform that provides a simple and intuitive trading experience.

FTUK Payment Methods: Funding Your Trading Journey

FTUK offers two convenient payment methods for funding your account:

- Debit/Credit Card: A quick and easy way to fund your account using your Visa, Mastercard, or other major credit/debit card. This method is widely accepted and provides instant access to your funds.

- Confirmo Cryptocurrency: Fund your account using popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin. This method offers increased privacy and security, with fast transaction times.

FTUK Additional Features: Enhancing Your Trading Experience

FTUK offers several additional features to enhance your trading experience and help you manage risk effectively:

- FTUK Copy Trading: FTUK allows FTUK copy trading, but only if you’re copying from accounts that you legally own. You can copy trades between accounts that are both inside and outside of FTUK. Also, your FTUK account can be either the one doing the copying or the one being copied.

- Account Protector: This feature automatically closes trades if your exposure on a single instrument exceeds 2% of your initial balance or if your overall account equity drops below 2% of the starting balance. This helps prevent significant losses and ensures compliance with FTUK’s trading rules.

FTUK Customer Support: Assistance Whenever You Need It

FTUK provides multiple channels for customer support:

- Live Chat: Access live chat support through the FTUK official website for immediate assistance.

- Email: Contact support via email at support@ftuk.com (mailto:support@ftuk.com) for detailed inquiries and assistance.

- Discord: Join the FTUK Discord server for community support and interaction with other traders.

- Social Media: Follow FTUK on Facebook, YouTube, and Instagram for updates, educational content, and community engagement.

- FAQs and Help Center: Find answers to common questions and access helpful resources in the FAQs and Help Center section of the FTUK website.

- Addresses: 6220 Westpark Dr, Suite 149 C1028, Houston, TX77057 | 3017 Boiling Way NE Atlanta, GA30305

Is FTUK Legit? Addressing Concerns and Building Trust

Is FTUK legit? This is a crucial question for any prospective trader. While no platform is without its critics, FTUK has generally maintained a positive reputation within the online trading community. They provide clear guidelines, a range of account options, and multiple support channels.

FTUK is legal and committed to providing a transparent and reliable trading environment. However, it’s always wise to conduct your own due diligence, read reviews, and understand the terms and conditions before engaging with any prop firm. Look at FTUK prop trading review to get a better understanding of other people’s experience with this prop firm.

FTUK is safe as long as you adhere to their rules and risk management guidelines. The Account Protector feature and clear drawdown limits are designed to help traders avoid significant losses.

Conclusion: Is FTUK the Right Prop Firm for You?

In conclusion, FTUK prop trading platform offers a range of account types, trading instruments, and platforms to cater to diverse trading styles and preferences. The FTUK challenge provides a structured evaluation process, while the free trial account allows traders to practice and refine their skills. With its commitment to customer support and risk management, FTUK aims to provide a reliable and transparent trading environment.

Whether FTUK is the right prop firm for you depends on your individual trading goals, risk tolerance, and experience level. Consider your options carefully, do your research, and make an informed decision based on your own needs and circumstances. – FTUK Review